- Why is insurance eligibility verification important

- Common challenges in insurance eligibility verification

- How to verify insurance eligibility and benefits

- How to automate medical insurance eligibility verification

- Benefits of real-time insurance eligibility verification

- Best practices for insurance eligibility verification

- How insurance eligibility verification reduces claim denials

- Phreesia: A leader in insurance eligibility verification

- How to get started with insurance eligibility verification

Insurance eligibility verification is the process of confirming a patient’s active insurance coverage and benefits before delivering healthcare services. This critical step ensures accurate billing, minimizes claim denials and improves the patient’s experience.

In a complex healthcare environment, ensuring accurate eligibility verification is important for maintaining financial stability and improving patient satisfaction. Whether you are a small healthcare organization or a large health system, this guide will walk you through everything you need to know about insurance eligibility verification.

Why is insurance eligibility verification important

Accurate insurance eligibility verification is essential for successful practice operations. Without it, providers risk delayed payments, increased claim denials and patient dissatisfaction.

Proper verification allows healthcare organizations to:

- Confirm active coverage: Ensure the patient’s insurance is valid at the time of service.

- Understand benefits: Identify covered services, co-pays, deductibles and out-of-pocket limits.

- Prevent claim denials: Address potential issues before they lead to denied claims.

- Improve patient experience: Provide transparency regarding financial responsibilities.

For healthcare providers, this means maintaining a healthier revenue cycle and focusing more on patient care.

Common challenges in insurance eligibility verification

The insurance verification process isn’t without its challenges.

Providers often face obstacles such as:

- Inconsistent information: Patients may provide incomplete or outdated insurance details.

- Manual errors: Human errors during manual verification can lead to missed or incorrect information.

- Payer complexity: Different insurance payers have unique requirements, making verification cumbersome.

- Limited resources: Smaller practices may lack the staff or tools to handle verification efficiently.

- Time-consuming: It’s often time-consuming to check individual payer portals to find eligibility information.

Recognizing these challenges is the first step to addressing them through automation and best practices.

How to verify insurance eligibility and benefits

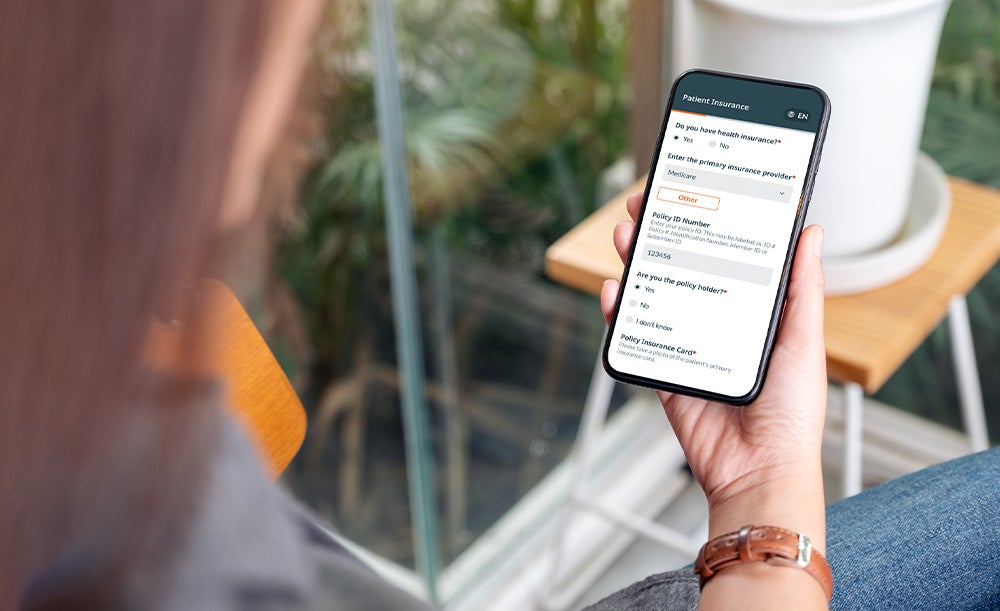

Verifying insurance eligibility involves a step-by-step process:

- Collect patient information: Obtain accurate details such as insurance ID, group number and personal data during scheduling.

- Contact insurance providers: Use online portals or call centers to confirm active coverage, co-pays, deductibles and out-of-pocket limits.

- Validate policy specifics: Check for pre-authorizations, co-insurance requirements and coverage for specific procedures.

- Document the results: Keep a detailed record of verified information for future reference and claims submission.

How to automate medical insurance eligibility verification

Manual insurance verification can be time-consuming and prone to errors. Automating this process through real-time insurance eligibility verification tools significantly improves efficiency.

Key benefits of automating eligibility verification include:

- Faster turnaround: Verify coverage in seconds with integrated software.

- Increased accuracy: Get rid of human errors with automated data matching.

- Sophisticated integrations: Sync with Electronic Health Records (EHR) and healthcare organization management systems.

- Enhanced patient experience: Improve accuracy of patient financial responsibility and simplify billing inquiries.

To ensure optimal efficiency and effectiveness, organizations should prioritize the following features when evaluating solutions:

- Integration with real-time AI tools to enable instant eligibility confirmation

- Multi-payer coverage across Medicare, Medicaid and private insurance providers

- Scalable technology that supports diverse patient populations without manual intervention

- Tools that combine eligibility verification with AI-driven copay selection, ensuring clear cost expectations for patients

- Robust compatibility with EHR systems to streamline administrative tasks and reduce redundant work

Benefits of real-time insurance eligibility verification

Real-time verification provides instant access to insurance information, benefiting both providers and patients:

For providers:

- Reduces claim denials: Ensures eligibility before services are rendered.

- Speeds up revenue cycle: Results in faster reimbursements.

- Free up staff time: Allows focus on higher-value tasks.

For patients:

- Minimizes financial surprises, creates a smoother experience.

- Ensures clarity: Provides understanding of coverage and out-of-pocket costs.

Best practices for insurance eligibility verification

To maximize efficiency and accuracy in insurance verification, healthcare providers should adopt these best practices:

- Verify early: Conduct eligibility checks as soon as appointments are scheduled.

- Standardize processes: Use checklists or workflows to ensure consistency.

- Leverage technology: Invest in automation tools that integrate with your existing systems.

- Train staff: Regularly train staff on insurance verification procedures and updates.

- Monitor and audit: Periodically review your verification processes to identify areas for improvement.

How insurance eligibility verification reduces claim denials

Claim denials can significantly impact a healthcare organization’s revenue cycle.

Insurance eligibility verification helps reduce denials by:

- Identifying coverage gaps: Ensuring the patient’s policy is active and applicable to the services provided.

- Avoiding authorization issues: Verifying pre-authorization requirements before delivering care.

- Clarifying cost responsibility: Communicating patient financial obligations upfront to avoid billing disputes.

Phreesia: A leader in insurance eligibility verification

At Phreesia, we help healthcare organizations streamline their eligibility verification process. With our tools, 100% of insured patients have their eligibility and benefits checked automatically, reducing claim denials and accelerating revenue cycles.

We support over 1,000 payers, encompassing Medicare and every state’s Medicaid program, ensuring diverse patient populations

We provide real-time eligibility and benefits verification, allowing staff to confirm patients’ coverage within seconds, reducing manual workload and minimizing errors

Our platform conducts automated eligibility checks multiple times before a patient’s visit, averaging three checks, to ensure up-to-date and accurate information

By integrating Phreesia’s tools, healthcare organizations can streamline their insurance verification processes, reduce claim denials and improve overall operational efficiency.

How to get started with insurance eligibility verification

Phreesia’s platform simplifies eligibility verification with robust automation and real-time insights. Our system integrates with leading EHRs and healthcare management software, leveraging our payer connections to enable AI-driven copay selection. This ensures a seamless experience for optimizing patient engagement and streamlining revenue cycle management.

Ready to upgrade your insurance eligibility verification process?

See how Phreesia can streamline your operations and improve patient satisfaction.